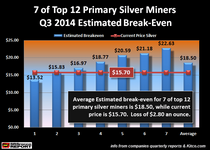

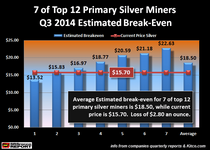

With more than half of the primary silver miners financial results for the third quarter finally out, the group is now losing nearly $3.00 an ounce at the current market price of silver. We can thank the Fed and Bullion Banks for rigging the paper silver price well below the estimated average break-even for the primary silver miners.

PRIMARY SILVER MINERS: Losing Nearly $3.00 For Every Ounce Of Production : SRSrocco Report

PRIMARY SILVER MINERS: Losing Nearly $3.00 For Every Ounce Of Production : SRSrocco Report

? I don't remember seeing anyone say that. But just like this "article" silver bulls sure seem to like to exaggerate don't they?

? I don't remember seeing anyone say that. But just like this "article" silver bulls sure seem to like to exaggerate don't they?