Gettintoknowsomethin

Full Member

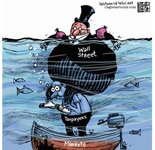

Could there be a "Bank holiday" in September?

Actually, before the end of September, there is a growing risk of a "bank holiday" similar to what was imposed by President Roosevelt in 1933. I cannot give a probability for this event, but it is not zero. Should there be a "bank holiday," account holders would not be able to access the funds in any of their accounts for an indefinite period. Even worse, there would be no access to safe deposit boxes. Any cash or precious metals stored in bank vaults would, therefore, also be out of reach for an indefinite period.On July 14, Greenlight Capital, the hedge fund that had been the largest shareholder in GLD (the largest gold exchange traded fund), revealed that it had disposed of its entire holding of 4.2 million shares of GLD (effectively about 420,000 ounces of gold worth almost $400 million) and replaced it all with physical gold.

This is an extraordinary move for any financial company. You can be sure that other hedge funds are studying this move to understand the profit motive behind such a strategy. They are probably poring over all the loopholes in the prospectuses of the various gold exchange traded funds looking for what they may have missed or not given serious consideration. If, and it is only if right now, any other hedge funds take a similar step, we could well see the floodgates open for the demand for physical gold.

Check out this link!

http://www.numismaster.com/ta/numis/Article.jsp?ad=article&ArticleId=7026

Actually, before the end of September, there is a growing risk of a "bank holiday" similar to what was imposed by President Roosevelt in 1933. I cannot give a probability for this event, but it is not zero. Should there be a "bank holiday," account holders would not be able to access the funds in any of their accounts for an indefinite period. Even worse, there would be no access to safe deposit boxes. Any cash or precious metals stored in bank vaults would, therefore, also be out of reach for an indefinite period.On July 14, Greenlight Capital, the hedge fund that had been the largest shareholder in GLD (the largest gold exchange traded fund), revealed that it had disposed of its entire holding of 4.2 million shares of GLD (effectively about 420,000 ounces of gold worth almost $400 million) and replaced it all with physical gold.

This is an extraordinary move for any financial company. You can be sure that other hedge funds are studying this move to understand the profit motive behind such a strategy. They are probably poring over all the loopholes in the prospectuses of the various gold exchange traded funds looking for what they may have missed or not given serious consideration. If, and it is only if right now, any other hedge funds take a similar step, we could well see the floodgates open for the demand for physical gold.

Check out this link!

http://www.numismaster.com/ta/numis/Article.jsp?ad=article&ArticleId=7026