DANGLANGLEY

Silver Member

- Oct 3, 2006

- 3,102

- 137

- Detector(s) used

- Garrett Ace 250, Tesoro Tiger Shark, Garrett AT Pro

- Primary Interest:

- All Treasure Hunting

I thought this was very interesting.

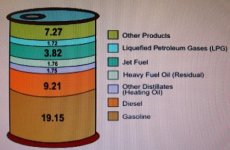

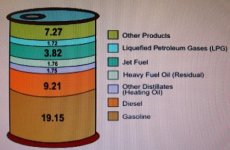

After crude oil is removed from the ground, it is sent to a refinery by pipeline, ship or barge. At a refinery, different parts of the crude oil are separated into useable petroleum products. Crude oil is measured in barrels (abbreviated "bbls"). A 42-U.S. gallon barrel of crude oil provides slightly more than 44 gallons of petroleum products. This gain from processing the crude oil is similar to what happens to popcorn, it gets bigger after it is popped. (note: The gain from processing is more than 5%.)

One barrel of crude oil, (42 gallons) when refined, produces about 20 gallons of finished motor gasoline, and 7 gallons of diesel, as well as other petroleum products. Most of the petroleum products are used to produce energy. For instance, many people across the United States use propane to heat their homes and fuel their cars. Other products made from petroleum include: ink, crayons, bubble gum, dishwashing liquids, deodorant, eyeglasses, records, tires, ammonia, and heart valves.

This proves that drilling, shipping and the associated pipelines account for only about 4% of crude oil that gets into our water. Drilling for oil pollutes our water so bad, yeah right

After crude oil is removed from the ground, it is sent to a refinery by pipeline, ship or barge. At a refinery, different parts of the crude oil are separated into useable petroleum products. Crude oil is measured in barrels (abbreviated "bbls"). A 42-U.S. gallon barrel of crude oil provides slightly more than 44 gallons of petroleum products. This gain from processing the crude oil is similar to what happens to popcorn, it gets bigger after it is popped. (note: The gain from processing is more than 5%.)

One barrel of crude oil, (42 gallons) when refined, produces about 20 gallons of finished motor gasoline, and 7 gallons of diesel, as well as other petroleum products. Most of the petroleum products are used to produce energy. For instance, many people across the United States use propane to heat their homes and fuel their cars. Other products made from petroleum include: ink, crayons, bubble gum, dishwashing liquids, deodorant, eyeglasses, records, tires, ammonia, and heart valves.

This proves that drilling, shipping and the associated pipelines account for only about 4% of crude oil that gets into our water. Drilling for oil pollutes our water so bad, yeah right